1925 West Field Court,3100 Sanders Road, Suite 200301

Lake Forest,Northbrook, IL 6004560062

March 22, 201923, 2022

Dear Stockholders,

You are cordially invited to attend the Annual Meeting of Stockholders of IDEX Corporation (the Company), in a virtual format only via the Internet, which will be held on Friday, May 10, 2019,6, 2022, at 9:00 a.m. Central Time, atTime. In order to attend the DoubleTree Hotel, 5460 N. River Road, Rosemont, Illinois 60018.Annual Meeting, vote during the Annual Meeting and submit questions, stockholders must go to http://www.virtualshareholdermeeting.com/IEX2022 and enter the 16-digit control number found in their proxy materials.

The meeting will be held virtually due to the continuing public health impact of the COVID-19 pandemic and to support the health and well-being of IDEX management and stockholders. The following pages contain our notice of annual meeting and proxy statement. Please review this material for information concerning the business to be conducted at the 20192022 Annual Meeting, including the nominees for election as directors.of directors named in this proxy statement.

As we did last year, we have elected toWe will provide access to our proxy materials and 20182021 Annual Report on the Internet and are mailing paper copies only to those stockholders who have requested them. For further details, please refer to the section entitled Summary beginning on page 1 of the proxy statement.

Whether or not you plan to attend the 20192022 Annual Meeting, it is important that your shares be represented. Please vote via telephone, the Internet or proxy card. If you own shares through a bank, broker or other nominee, please execute your vote by following the instructions provided by such nominee.

On behalf of the Board of Directors, I would like to express our appreciation for your continued interest in the Company.

Sincerely,

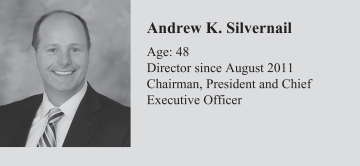

ANDREW K. SILVERNAILWILLIAM M. COOK

Chairman of the Board President and

Chief Executive Officer

Please fold and detach card at perforation before mailing.

Please fold and detach card at perforation before mailing.